Global HR — 8 min

Contractor Management — 9 min

If you work for a large company, late payments from your client can be frustrating and be an inconvenience, at most. If you’re a freelancer, and especially if you don’t have a steady stream of work coming your way, delayed payments can mean an empty fridge!

You’ve got to do your part when it comes to getting paid on time, and this includes making sure your invoice is on point. When it comes to invoicing, you only have to get it right once, and the rest will fall in place.

This handy guide on invoicing will explain the type of invoices, what you need to include in an invoice, and invoicing mistakes to avoid. We’ve also included a freelancer invoice template that you can edit and use as a starting point.

It’s easy to miss small details when you’re putting together an invoice for the first time. Mistakes not only delays payment but can also appear unprofessional and be frustrating for your client.

Use the following checklist for what to include in a freelancer invoice to avoid missing key details:

An informative header tells your client exactly who sent the invoice.

Include your name, business name, and logo. To ensure the header’s readability, use a clear font, and make your header text larger than the text in the rest of the document.

Include your business or personal phone number and email address. You can also include your website or social media handles if you use these platforms for client communications.

Although your invoices are useful for the client you’re billing, they also help you keep a record of the work you’ve done and your income.

Any client information you include in your invoice must match the information in your contract. Clients may delay your payments — or withhold them entirely if there are differences.

The invoice number helps you keep track of your invoices and stay organized even when working with multiple clients.

If a client has any issues or you need to track down a payment, you’ll be able to use the invoice number to easily find the relevant invoice. Then, you can compare notes and settle the dispute.

The payment timeline starts from the date you send the invoice. Explicitly listing your issue date and payment due date provides clarity and removes the likelihood of confusion or misunderstanding.

Pro tip: including the issue date and payment due date is also a way to distinguish one invoice from another if you make a mistake with your invoice numbering system.

This is the most important part of your invoice. The breakdown of services section is where you provide a detailed description of the work you’ve done and the amount you’re charging for it.

Depending on the nature of your work, you could include the hours you worked and your hourly rate or the tasks you completed and your rate for each task.

Your rates should always reflect the amounts agreed upon in the initial estimate or quote you gave to each client.

Include the total invoice amount immediately after your breakdown of services section. If applicable, include tax amounts in your total.

Many businesses are wary of working with freelancers due to concerns with tax compliance, so working out and including the tax amounts on their behalf goes a long way toward increasing their chances of working with you again.

If you’re offering your client a discount, describe the discount and display the new total directly beneath the original total cost.

Including both totals makes the discount clearer and reminds your client of the special offer you’ve given them.

This section states your preferred payment method, gives your client payment options, and outlines your payment terms and policies regarding early or late payments.

To make it as easy as possible for clients to pay you, include multiple payment options or platforms that you’re comfortable with, as well as all the information they’ll need to make the payment.

Many freelancers offer discounts for early payments and include penalties for late payments. These invoice features can incentivize your clients to pay promptly and reduce the unpredictability of freelance income.

In this final section, you may include additional notes you may have regarding the project. If you’re using a recurring or partial invoice (more on those later), you can include information about future payments and project progress.

This section is also a good place to thank your client for trusting your business. Including a personalized message will help build a friendly working relationship with the client and make them more likely to seek out your freelance services in the future.

Use the template below as a starting point to create your invoice structure that you can use and reuse for years to come.

Simply copy and paste the text into your program of choice to add your details. Then, personalize the template to match your freelance business’s branding.

Phone number:

Email address:

Website URL:

Social media handles:

Client name:

Client phone number:

Client email address:

Hours worked | Hourly rate

Tasks completed | Task rate

Banking details | PayPal | Wise | SnapScan

Using different types of invoices can help you stay organized and keep your clients informed while you’re providing your services.

Here are the main types of invoices you can use as a freelancer:

A proforma invoice is similar to a quote. It outlines the goods or services you’ll provide for the client, estimates the associated costs, and lays out the anticipated payment deadlines.

This type of invoice is a “good faith” agreement to the terms of your service. Your client can see your cost breakdown and decide whether to spend money on your services.

Pro tip: If you work as a remote contractor, use this guide to learn more about how employers determine fair compensation.

An interim invoice is essentially a “progress invoice.” It divides the total payment for a large project into smaller — often monthly — portions.

Using interim invoices is a great option if you work on projects for months at a time. For example, if you charge $2,400 for a year-long project, you could send monthly invoices for $200 each.

A collective invoice groups the charges for many small projects for the same client into one lump payment. Collective invoices simplify filing and reduce paperwork and transaction fees for your client.

A final invoice is the last invoice you send to your client. It clearly outlines what you did for them and what they owe you.

This type of invoice includes payment due dates and informs clients of late-payment fees and the consequences of missing payment due dates.

You can use a recurring invoice if you provide ongoing services for a client. These invoices come at the same time every month, include a set payment amount, and remind the client what they’re paying for.

Recurring invoices work well for subscription services, monthly appointments, or services such as weekly gardening or pool cleaning.

A past-due invoice alerts your client that the payment due date has passed and tells them whether they’re liable for late fees.

It’s worth learning how to structure and send a past-due invoice because only 26% of freelancers in the US receive on-time payments for all of their invoices.

When invoicing, your goal is to be professional and avoid delayed payments.

Here are some general tips for invoicing as a freelancer:

It’s important to review what you and your client agreed on before you set up your invoice.

To prevent payment delays, you want your invoices to be indisputable. Be clear about who you are, what work you did for your client, when you provided your services, and how you priced your services.

To protect your relationship with your client and ensure smooth correspondence, be sure to outline any additional fees your client will be responsible for in your initial quote.

When it comes time to invoice, include these payment details in the breakdown of your services.

The ideal time to send an invoice varies depending on the nature of your work, the client you’re dealing with, and the size of the project you’re billing for.

In most cases, it’s appropriate to invoice a client when you know they’re satisfied with the work you’ve done. However, you can also choose to send partial invoices throughout the project’s duration.

Your clients must take you and your business seriously. Maintain a professional tone throughout your correspondence with each client to ensure they see you as a legitimate business.

Many freelance contractors struggle with unpredictable or inconsistent incomes. Reduce this financial uncertainty by shortening your payment terms.

Don’t worry about appearing pushy by shortening your payment deadlines — everything moves fast in today’s world.

Mistakes in an invoice not only appear unprofessional but can also delay payment. Be sure to check and double-check your invoices before sending them to your clients.

Your invoices reflect your business, so it’s worth making an effort to make them appear professional. Here are some common invoicing mistakes to avoid:

Whether you’ve included hidden fees or made a mistake with your figures, it’s inappropriate to invoice your clients for amounts they haven’t previously agreed on.

If you’re likely to incur hidden fees, be upfront about the potential for additional costs when you provide a quote for your services.

When compiling your invoices, don’t leave anything up to interpretation. Be clear and explicit in your breakdown of services section to reduce the chances of discrepancies or confusion.

While you likely interacted and formed friendly relationships with your clients while working for them, it’s still important to maintain a level of professionalism when compiling your invoices. For instance, what would it say about you or your business if the invoice has terrible formatting or uses an illegible font?

You are working as a business to provide your services, so your invoices should reflect your competency.

Invoicing the wrong client is the ultimate no-no. Organize and track of your invoices so you don’t make this mistake.

Don’t make your client jump through hoops to pay you. Offering multiple payment options lets your clients choose the most convenient option for them.

Throughout your freelance career, you’re likely to encounter difficult clients, receive the wrong payment amounts, or be forced to wait for late payments.

Here are some tips for handling tricky clients or missed payments:

Remember that as a freelancer, your reaction to unexpected situations directly influences the chance that you’ll work with a client again. Showing grace and patience in difficult circumstances can build trust and loyalty with your client.

When you notice a payment is late, check in with the client to see why they’re late to pay. Chances are they’ve simply forgotten the payment date.

Consider setting up automatic payment reminders to alert your clients if they’ve missed a payment.

If your client still doesn’t pay or doesn’t come up with a payment plan you’re satisfied with, gently but firmly remind them of the consequences of non-payment. These consequences should be laid out in the contract you and the client both signed before you began your work.

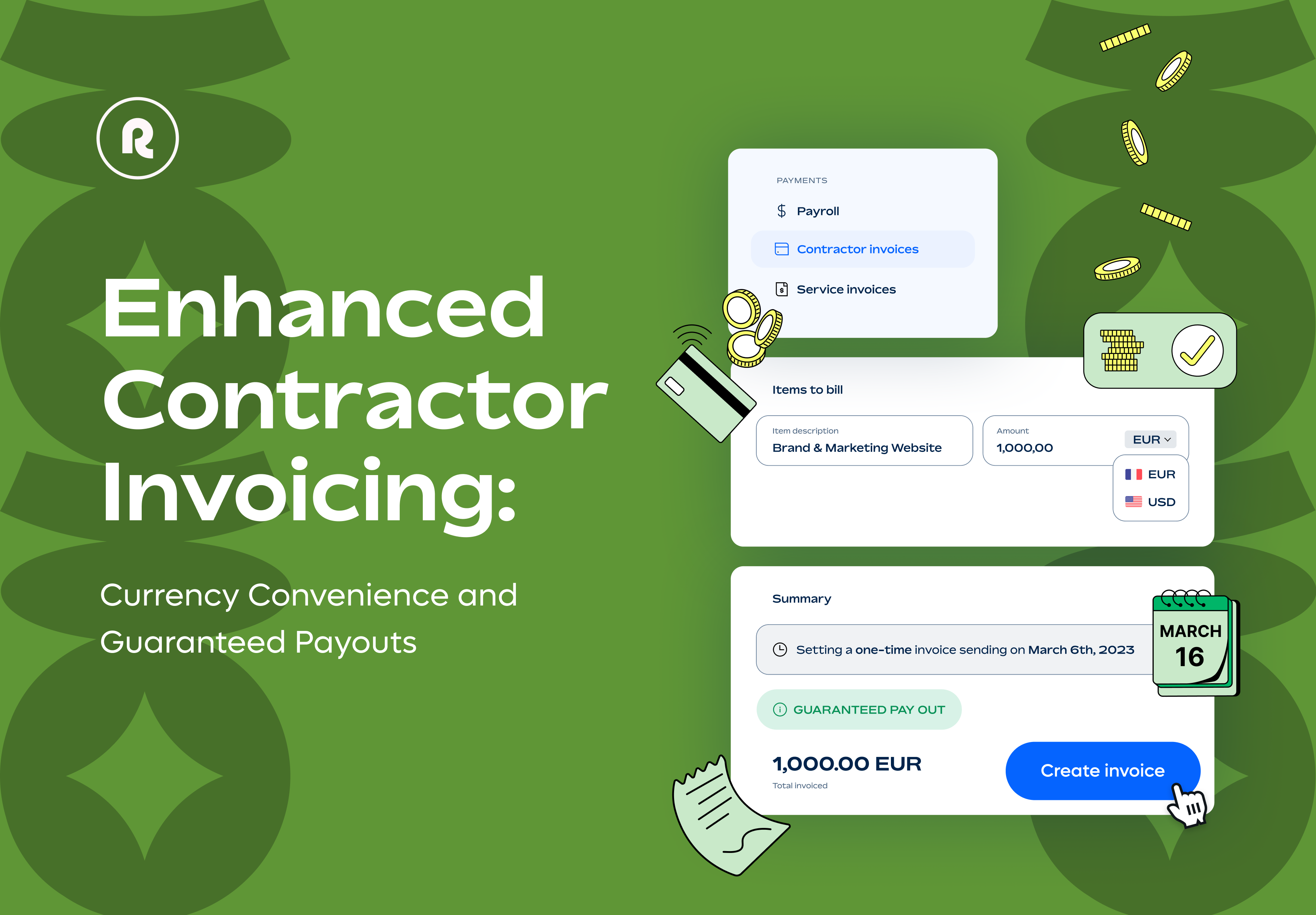

If you’re finding it difficult to manage your invoicing and payments process, Remote can help.

Our trusted and reliable contractor management platform is designed to help both freelancers and clients manage their contractors Remote makes it easy for any freelance contractor to gain visibility into the progress of their payments.

Our platform allows you to track payment timelines and payout dates in real-time and from one centralized location.

The Remote platform allows you to:

View a detailed timeline for each invoice you send

Track payment progress, from issuing to approval and processing

See expected payout dates so you know when payments will land in your bank account

Whether you’re just getting started with your freelance career or you’ve been self-employed for a while, Remote makes it easy to manage your business.

Our contractor management platform gives companies around the world access to the best global talent so they can scale their businesses and succeed in today’s competitive economy. Learn more about how Remote can help contractors take charge of their business and ensure smooth sailing when it comes to invoicing and payments.

Sign up with Remote for locally compliant contract templates and simple payments at just $29 per month, with no hidden fees.

Subscribe to receive the latest

Remote blog posts and updates in your inbox.