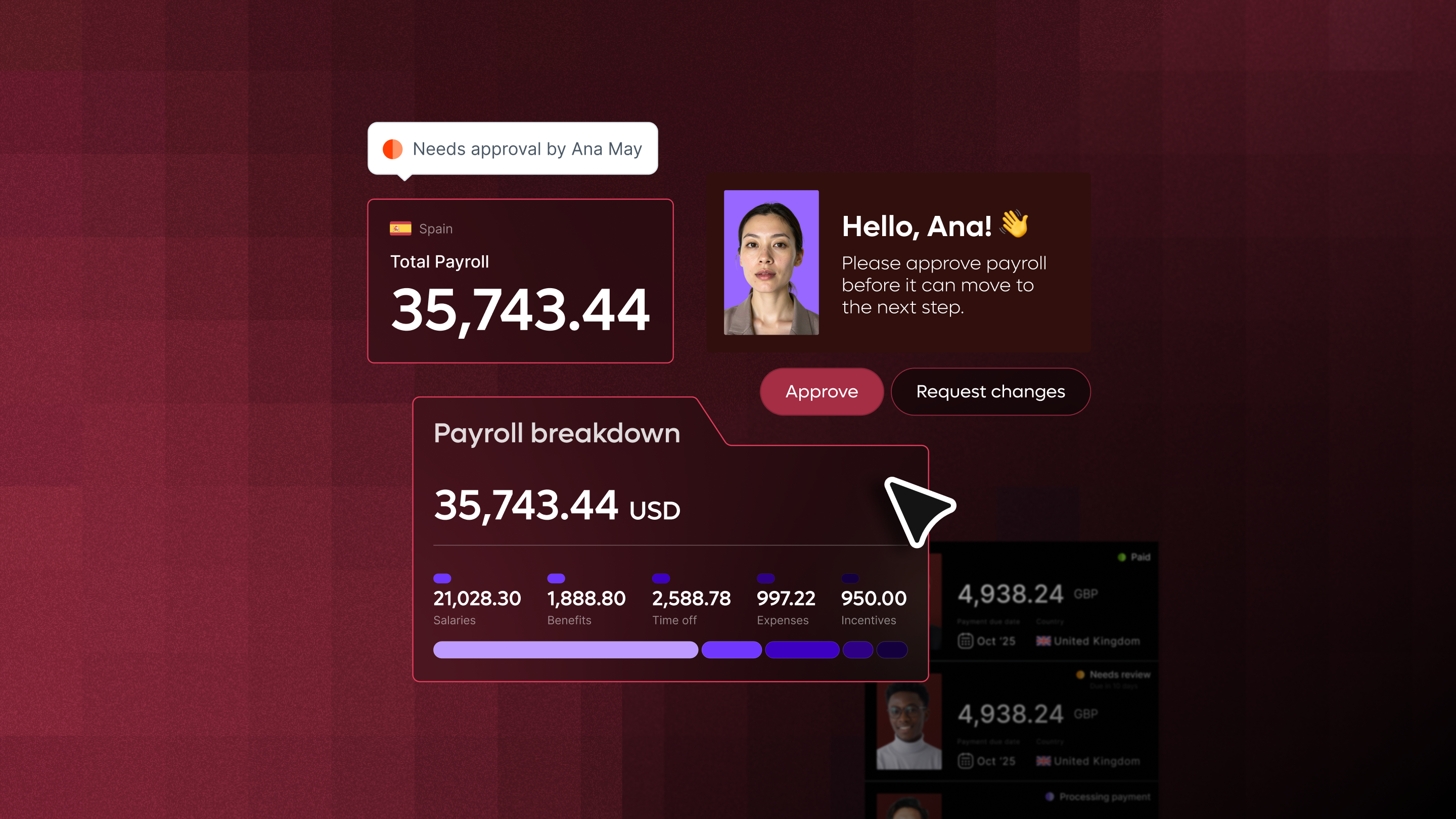

Book a demo, see Remote in action

Manage, pay, and recruit global talent in a unified platform

%20Logos%20Library/(Approved)%20Trust%20symbols/lg-xs-g2-reviews-book-demo.webp?width=112&height=114&name=lg-xs-g2-reviews-book-demo.webp)

%20Logos%20Library/(Approved)%20Trust%20symbols/lg-xs-trustpilot-reviews-book-demo.webp?width=122&height=114&name=lg-xs-trustpilot-reviews-book-demo.webp)

%20Logos%20Library/(Approved)%20Trust%20symbols/lg-xs-capterra-reviews-book-demo.webp?width=118&height=114&name=lg-xs-capterra-reviews-book-demo.webp)

Start employing anywhere

We'll answer your questions, walk you through how our platform works, and help you start employing talent compliantly anywhere.

%20Illustration%20Library/051-check-star-stamp.webp?width=132&height=128&name=051-check-star-stamp.webp)

Successfully submitted!

If you scheduled a meeting, please check your email for details or rescheduling options. Otherwise, a representative will reach out within 24–48 hours.

%20Blog%20Images/Blog%20Images/What%20is%20a%20payment%20stub%20and%20how%20do%20you%20make%20one%3F%20hero%20image.png)

%20Blog%20Images/Blog%20Images/Global%20payroll%20automation.png)

.jpg)

.jpg)