As a startup founder, equity distribution is one of the most crucial decisions you'll make. The right amount has the potential to attract top talent, motivate employees, and align everyone's interests toward your company's success. However, the decision process can be complicated and fraught with potential pitfalls, especially for your earliest employees.

To help you make the right decision — and strike the right balance between fairness and strategic growth — here’s what you should consider.

Why are the first 10 employees so important?

The first 10 employees in a startup are more than just workers; they are the pioneers who will shape the company’s culture, execute your vision, and carry the weight of your early successes and failures.

These individuals play a significant role in setting the tone for your company's future, making it essential to offer them attractive compensation packages — including equity.

What to consider when determining equity amounts

When deciding how much equity to offer your first 10 employees, consider three key factors: their contribution, the risk they are taking, and their future potential within the company.

Contribution

Each employee's contribution should be evaluated based on their role, and their impact on your company's short-term and long-term goals.

For instance, key hires like CTOs or lead developers might warrant more equity due to their critical contributions to product development and technology strategy. Those key hires are of the utmost importance in the early days of a company, so it’s usually recommended to provide more equity early on based on these factors.

Risk

Joining a startup, especially in its early stages, involves considerable risk for many individuals. Your early hires will likely be leaving stable jobs to join your venture, with uncertain prospects. Offering equity is a way to compensate for this risk and acknowledge their belief in the company's vision.

Future potential

Another key consideration is the future potential of each employee. When allocating equity, try to identify those hires who show promise for leadership roles, or who have unique skills that will be essential as your company grows. These individuals should be incentivized accordingly to ensure their long-term commitment.

Structuring your employee equity packages

Structuring your employee equity packages effectively is also crucial for maintaining motivation and retention.

Here are some tips and best practices for doing this:

1. Implement a vesting schedule

Implement a standard vesting schedule to ensure your employees remain committed over the long term. While traditional vesting includes a four-year schedule with a one-year cliff, recent trends suggest shortening that schedule to two years with a one-year cliff, or even removing the cliff entirely.

When structuring the cliff, you always want to balance how quickly the employee starts to earn equity with how motivated you want them to be for the project in the long term

2. Communicate clearly

Make sure your employees understand the value of their equity and how it can grow as the company succeeds.

This is essential for early startup employees. As we established earlier, employees of early stage startups are taking a risk by choosing your company over a stable job with a big established firm. That means they expect higher potential rewards, and need to have a clear perspective on how their equity will benefit them at each stage of their career at your company

3. Adjust as necessary

Be willing to adjust equity packages based on performance and evolving roles within the company. This means refresher and tenure grants to employees that have earned them, as well as other equity-related benefits.

Case study: Kevin Jurovich

Kevin Jurovich, a seasoned startup founder, recently discussed how he manages equity distribution in his companies.

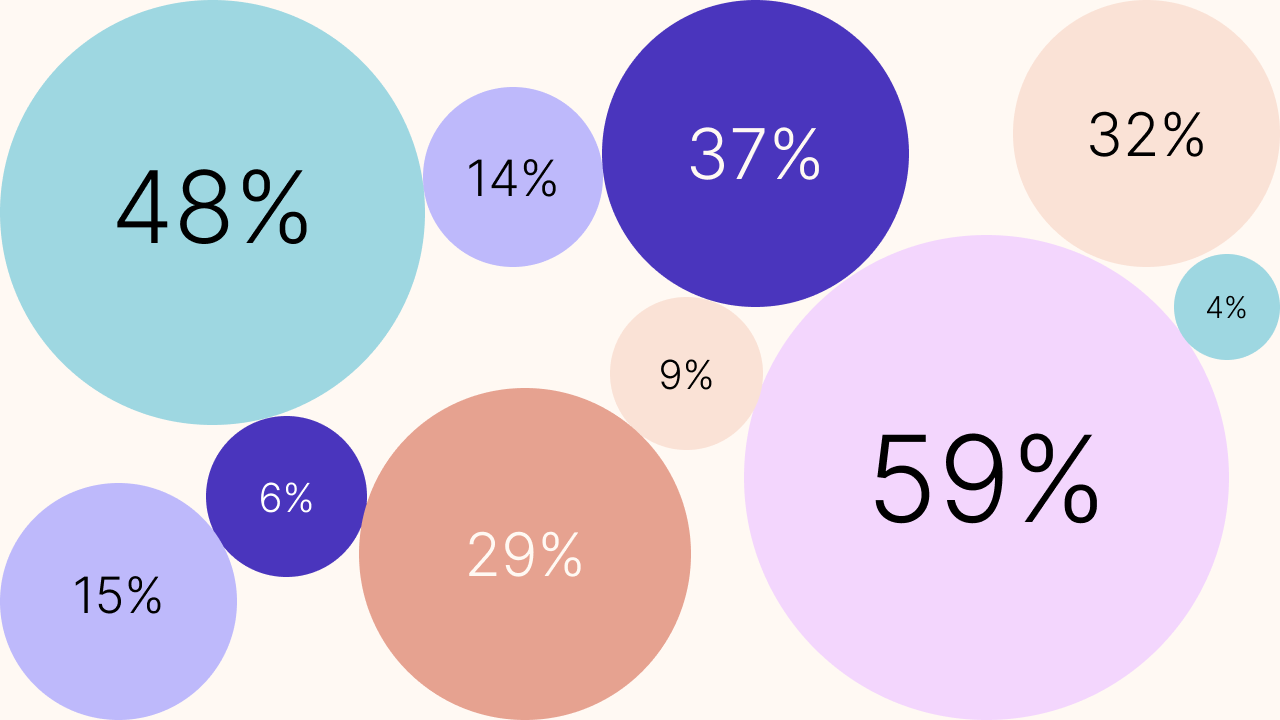

According to Jurovich, you should assign around 10% of the company's equity to the first 10 employees, with a strong emphasis on financial success for those early team members. Specifically, the average equity for early hires should be:

- Hire 1: 1.27%

- Hire 3: 0.52%

- Hire 5: 0.34%

- Hire 7: 0.24%

- Hire 9: 0.20%

Jurovich also stresses the need to balance attracting and retaining top talent while ensuring the company retains enough equity to attract investment and grow.

How can Remote help?

Determining how much equity to give your first 10 employees is a crucial early step. But by considering factors such as contribution, risk, and future potential, and by following industry benchmarks and best practices, you can create a fair and motivating equity distribution plan. Remember, the goal is to build a strong, motivated team that shares in the company's success and is committed to its long-term growth. With a thoughtful approach to equity distribution, you can lay the foundation for a thriving enterprise.

You also need the right partner, too, to make setting up and managing equity incentives a headache-free, hands-off process.

Remote Equity can handle all the heavy legal lifting for you — even if you have employees in different countries or you hire through an employer of record (EOR).

To learn how we can simplify and demystify equity incentives for your team, speak to one of our friendly experts today.

%20Logos%20Library/(Approved)%20Trust%20symbols/lg-xs-g2-reviews-book-demo.webp?width=112&height=114&name=lg-xs-g2-reviews-book-demo.webp)

%20Logos%20Library/(Approved)%20Trust%20symbols/lg-xs-trustpilot-reviews-book-demo.webp?width=122&height=114&name=lg-xs-trustpilot-reviews-book-demo.webp)

%20Logos%20Library/(Approved)%20Trust%20symbols/lg-xs-capterra-reviews-book-demo.webp?width=118&height=114&name=lg-xs-capterra-reviews-book-demo.webp)

%20Illustration%20Library/051-check-star-stamp.webp?width=132&height=128&name=051-check-star-stamp.webp)